A delayed index points to a turning point in October 2016

The Business Climate Monitor published for October last year by the Institute for Public Policy Research, came across my desk last week.

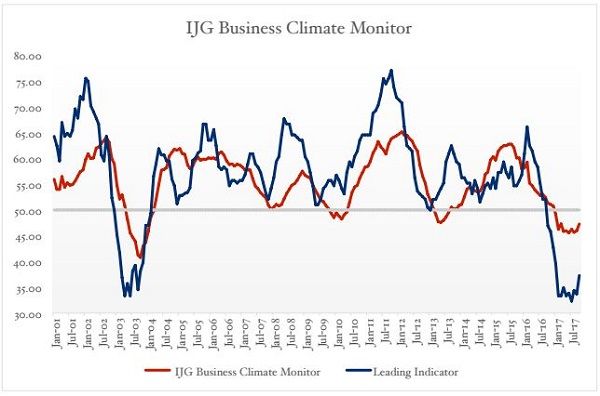

Why the compilers, IJG Research, chose to release it so late I do not know. In a sense it is outdated except for one crucial aspect. It shows a clear and well-defined turning point in both the set of leading indicators and the current environment as it was at the end of October 2016.

In IJG’s own words: “The IJG Business Climate Monitor posted its biggest gain for the year in October, climbing 1.34 points and bringing the index to its highest level since January 2017. The leading indicator boasted an even more impressive gain, climbing 3.6 points. While the index remained below the 50-point line indicating an economic contraction, the relatively strong increases indicate a contraction at a slower rate.”

To regular Economist readers it must be obvious that my main area of expertise lies in macro-economics. Also in my writings on the economy, it shows that I am always concerned with macro trends.

Many analysts will argue that macro follows micro. The bigger picture in the economy can not come to the fore without the myriad of underlying transactions and relationships first working their magic.

That is true, but it can also not be argued away that our problems which started at the end of 2015 originated in the macro sphere. As 2016 went along, it became clear that the reason for the downturn was the contraction in the fiscus. When government income came under pressure, the deficit ballooned, the government drained local liquidity, and despite many positive “green shoots” in micro, macro continued to show a calamitous 2017.

As can be seen from my last installment in 2017, I lamented the fact that the micro bright spots, of which there are several, failed to have an impact on macro. In short, the economy as a whole continued to contract, posting one negative quarter after another.

This is why the belated Business Climate Monitor attracted my attention.

October, being the first month of the final calendar quarter, shows a revival of sorts. The monitor’s methodology, in my mind is sound, despite being somewhat convoluted. And it has a long history so trends are clearly definable and since they go to such pains to eliminate distortions, it is certainly a reliable snapshot of both actual conditions and sentiment.

If there was a marked turn-around at micro level in October, what does this say for November and December. Can you see where I am going with this?

I expected the third quarter to be marginally positive but it did not happen because the banks parked their available liquidity in the capital market instead of investing in the economy. I can fully understand why the economy’s financiers are reluctant to put more money investment. After six years of aggressive investment and stellar GDP growth rates, there is very little on the productive side to show for that massive stimulus.

Be that as it may. If there was an obvious change in flavour in October, is there then a reasonable expectation that November and December could further add to that slight momentum?

And if there are three slightly positive months in a row, is it possible that the fourth quarter may turn out some growth, even if only a spittle.

From the official side, we will have to wait until the second week in February before we get the fourth quarter statistics. Until recently I was not looking forward to this as another contraction would have added only more disappointment. That was until IJG sent me their Monitor. Now I am wondering (hoping) to see some effect in macro. Maybe, just maybe, last year ended with a positive quarter.

The economy has been deleveraging since the second quarter in 2016. It remains an open question how much excess investment must still be unloaded, but I am fairly confident that we are near the end of the process, or has actually completed the cycle.