Wait and see, is the watchword for investors now. Will the minister pull it off?

Since the finance minister’s mid-year budget review of last week, I am bombarded with questions about the economy. Below I tried to distill a brief overview from two much longer reports I prepared for third parties.

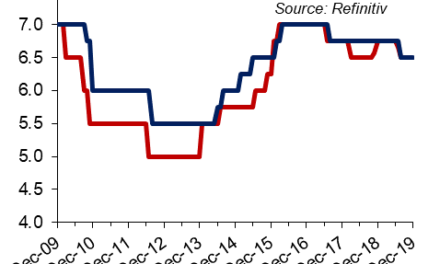

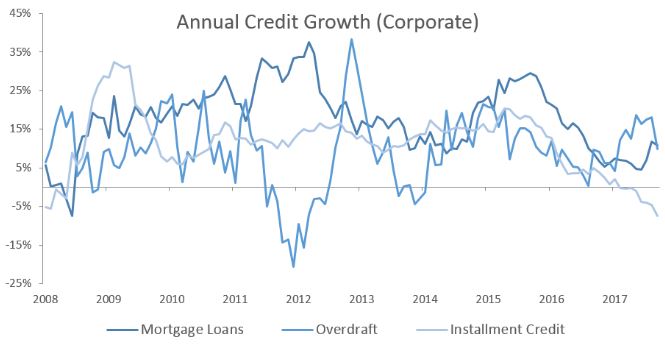

September Private Sector Credit Extension disappointed once again with the 5.24% reading. A slightly deeper look into the sub-components also does not show the green credit shoots we are all so desperately looking for. Installment credit has for all practical purposes stalled while overdrafts continued to grow moderately.

This is most certainly a sign that households have stopped buying and that everybody is treading water. People borrow just enough to cover current expenses and then only for the short term. Mortgage growth is kept barely alive but only by commercial enterprises. The reason is quite clear, expectations for economic growth are either indeterminable or negative thus investment is held back. This is a negative sign for future growth but it also shows that there is much slack in capacity and I believe most businesses will be ready to react very fast when the first signs of improved economic momentum becomes visible. (The graph for Corporate Sector Credit Growth comes courtesy of IJG Research)

Bank liquidity is still positive and decent, in the order of around N$2 billion per day but a decreasing trend is clear. The enhanced liquidity, around N$4 billion per day on average of two to three months ago, has now been halved.

Demand for government bonds and treasury bills are still robust but not as strong as in July and August. Oversubscription generally declined from highs of three to three and a half times, to about 1.6 times. Although this is an intentional oversimplification, the so-called switch auctions say a lot about demand and maturities.

The switch auction for 2017 maturities was hugely successful, saving the government more than N$1 billion in upcoming commitments through a single auction. The switch auction for 2018 maturities was good but perceptibly more subdued than the first. The results show there is very little demand, if any, for any instruments dated 2025 or longer. Nevertheless, last week’s switch auction relieved the government of another N$215 million capital market commitments due next year. Not insignificant but not nearly enough to restore momentum.

A negative signal is the decrease in the number of bids. For the GC20 and GC27 bonds, only four bids each were received but for the GC22 there were 11 bids on the table. This is usually when banks buy since their trading desks typically work on a 60-month mandate. I suspect this may also be one of the reason why bank liquidity is on the decline. Banks may be using the capital market to park funds and I doubt they will relinquish their position unless there are clear signals of a revival.

The dynamic between capital market and bank liquidity must not be ignored. The government’s drain on local liquidity last year was the main reason for negative bank liquidity from December 2016 to the first week of May this year. In my view, the banks are now overcapitalised putting them in an ideal position to move and to move aggressively when general economic conditions normalise. This will lead to a rather dramatic turn-around of Private Sector Credit’s demise, but of course, the precondition is that banks must start lending again.

With last week’s mid-year review of the budget, the Minister of Finance offered some very valid points and I am convinced that he would not have asked for N$4 billion more, were he not convinced that revenues will improve, or alternatively, covered his bases by making sure financing arrangements are in place.

But as the new PDM pointed out in the National Assembly on Thursday, the minister’s assumptions are on extremely thin ice and there is no way that he will know whether they are realistic until March next year. Until then, it remains borrow and spend, borrow and spend!

It is interesting to note that Fitch confirmed Namibia’s rating in June this year, about six weeks before Moody’s downgraded us. Do not be fooled by the so-called Fitch upgrade in Augustus. That was not an upgrade, it was a technical adjustment following South Africa’s downgrade, to keep us one notch above them on the zaf scale.

At this point, the only positive item is the elevated foreign reserves. However, in my view this is dead money. It does not help us one bit when it just sits there. It does nothing to restore confidence in the local economy. Foreign reserves are now high enough, that we can easily draw down the N$4 billion the minister needs for his budget, without endangering the balance of payment current account, or the stupid ZAR peg. Mind you, if your reserves are more than your currency in circulation by a factor of seven, then it shows your finance ministry is the engineer of the low liquidity, and not the other way around.

By this time of the year, the Ministry of Finance’s budget officials, the National Planning Commission and the Namibia Statistics Agency should be deeply engrossed in daily meetings with officials from the International Monetary Fund for the so-called Article IV Consultations. But everything is quiet on that front, leading me to believe that there is much cooking. In the past, the ministry was quite forthcoming with information on these consultations but this year the silence is deafening. I am just wondering why everyone involved, is holding back.

Personally, I do not think Fitch will downgrade us, or at least there is no compelling reason to do so. If we are compared to our peers, all metrics are more or less in line. The only problem is, all the other have been downgraded so now it will be an anomaly to keep us at investment grade. Furthermore, it will also certainly create some investment tension when one agency has downgraded us while the other says, wait and see.