Old Mutual plc unbundles creating four new independent commercial entities

Employing a live digital “showcase” Old Mutual plc, the London-listed Old Mutual holding company, announced on Wednesday in Johannesburg its intention to list a new entity, Old Mutual Limited on the Johannesburg Securities Exchange early in 2018.

Branding the text book unbundling a “Managed Separation” Old Mutual plc said the new entity, Old Mutual Limited will become the South African holding company for Old Mutual Africa under Old Mutual Emerging Markets, the parent company of Old Mutual Namibia.

Old Mutual Limited will for the time being hold a 54% stake in Nedbank Group Limited and also incorporate residual elements of the London parent. Old Mutual Limited will have a primary listing on the JSE and a secondary listing on the London Stock Exchange.

Also on Wednesday 01 November, Old Mutual Limited announced it has agreed with Nedbank that subsequent to the unbundling of the majority of its shareholding, it will retain a minority shareholding of 19.9% to serve as a foundation for the continued strategic relationship between the two companies.

On 30 October 2017, Old Mutual Group Holdings Limited (SA), the South African intermediate holding company for Old Mutual Emerging Markets and Nedbank, announced the appointment of additional non-executive directors. “It is planned that this will become the new board of directors for Old Mutual Limited,” the company stated.

The process to unbundle the behemoth Old Mutual plc started on 11 March 2016 when the Managed Separation was first announced. This was followed up by an announcement on 25 May this year, at which point it was stated that Old Mutual Limited will retain a strategic minority shareholding in the Nedbank Group.

The decrease in Old Mutual Limited’s shareholding in the Nedbank Group to 19,9% will be achieved through the distribution of the balance of Old Mutual Limited’s majority shareholding in the Nedbank Group to its shareholders, at an appropriate time and in an orderly manner, post the listing of Old Mutual Limited. “Old Mutual Limited does not intend to sell any part of its shareholding in the Nedbank Group to a new strategic investor,” Old Mutual plc stated on Wednesday.

Earlier in the process, Old Mutual plc said “the managed separation strategy aims to unlock and create significant long-term value for our shareholders which is currently trapped within the Group structure as well as removing the significant costs arising from that structure. We intend to unlock value through the separation of the four businesses from each other.”

The first step was to turn Old Mutual Asset Managers into an independent entity and then to relinquish shareholding in several other entities, of which some of the proceeds were used to reduce the plc holding company debt after a £273 million repurchase and redemption in February 2017.

Old Mutual plc expects the listing of Old Mutual Wealth and Old Mutual Limited to take place in 2018 at the earliest opportunity after release of the group’s full year financial results.

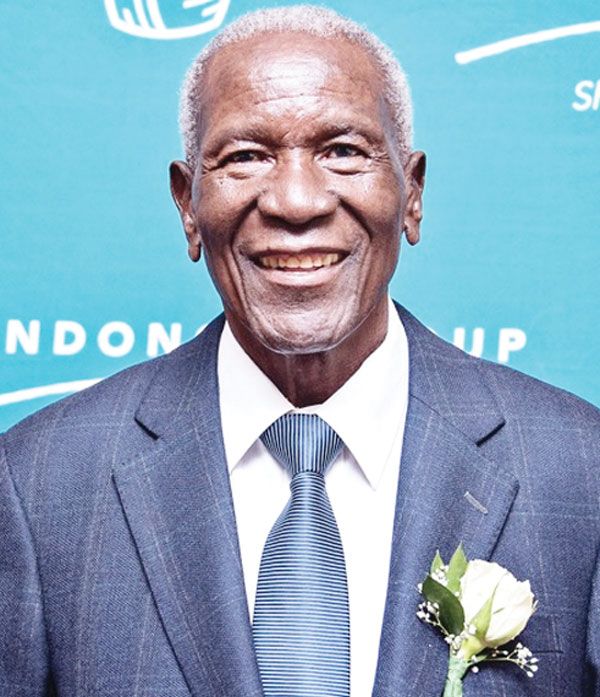

Pictured is Peter Moyo, the Chief Executive of Old Mutual Emerging Markets which will become a subsidiary of the soon-to-be-listed Old Mutual Limited on the JSE, following the successful unbundling of London-listed Old Mutual plc.