Emerging uranium supply shortage may lead to price overshoot – Deep Yellow’s Borshoff

It is inevitable that the looming shortfall in uranium stocks will lead to a recovery of the commodity. Uranium supply growth in the mid to longer term is highly uncertain and there is some nervousness amongst nuclear utilities over an adequate supply of uranium in the future.

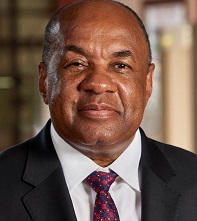

The Managing Director of Deep Yellow Ltd, John Borshoff told a gathering of mining executives and investors in Perth, Australia, it is irrelevant whether the shortfall occurs in 2020 or 2022, it is inevitable.

Borshoff, the founder and former CEO of Paladin Energy, is now the driving force behind Deep Yellow Ltd, an exploration company listed on the Australian Stock Exchange with a dual-listing on the Development Capital Board of the Namibian Stock Exchange. Deep Yellow is the main shareholder of Reptile Uranium, the exploration company that discovered the Tubas and Tumas mineralisations in the Namib desert.

“The supply shortage is inevitable and the certainty of future uranium supply is the core concern for utilities” Borshoff told the delegates at the Paydirt 2017 Africa Downunder conference.

“This reality will cause progressive upward price movement with clear potential for the price to overshoot” he said cautioning that the future supply concerns can be exacerbated since there are few companies with the proven capability to build and operate large production facilities to fill the emerging uranium supply shortage.

But Borshoff is extremenly upbeat about Deep Yellow’s prospects in Namibia. He used the conference as a platform to announce another major discovery in Reptile Uranium’s quest to find high yielding uranium deposits.

Drilling work in Exclusive Prospecting License EPL3497, only some 50 km away from the Langer Heinrich mine, has lead to the discovery of Tumas 3. This mineralisation shows similar characteristics to Langer Heinrich.

Drilling 400 holes over a four-month period, Reptile discovered mineralisation in 284 holes. The uranium ore body is relatively shallow, encountered first at just over five metres and extending down to around 21 metres. The thickness of the ore layer varies from three to 14 metres.

Borshoff said Deep Yellow is now targeting a uranium resource base exceeding 150 million pounds uranium oxide.

Punting Deep Yellow’s plus points, he said their strategy is now clearly defined under its new management. A strategic alliance with financing partner Sprott is in place and the investor base is regenerated. After a round of capital raising in June this year, Deep Yellow has access to Au$14.5 million.

The current uranium market is analogous to the depressed condition of around 15 years ago. This creates an opportunity for high wealth creation following a contrarian investment approach, according to Borshoff.