FNB to increase lending

FNB Namibia has set itself the goal of aggresively growing its asset base despite the central bank’s concerns of increasing credit extension to private households.

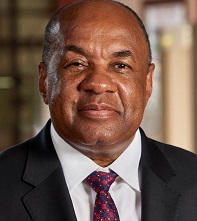

CEO, Ian Leyenaar told The Economist on Thursday that the bank will have to increase its asset base to cushion itself against lower interest rates currently prevailing in the country. He said the lower interests rates were squeezing margins.

“When you have decreasing and low interest rates your margin comes into play .. therefore if you want to increase your net interest income you have to grow advances.

“…. we are hard pressed to grow the interest margins and that means we have to lend a lot more money. In the coming financial year we are focusing significantly on asset growth. Growth should be well in excess of the 13% of the last financial year,” Leyenaar said.

In the financial year ended 30 June 2012, FNB Namibia increased total advances by 13% to N$14 billion while total assets grew to N$19.7 billion. The non performing loans ratio fell to 1.3% compared to 1.9% in the previous financial year.

Leyenaar said the bank will be responsible in its lending policy. “We will carefully assess before we lend. We don’t want to just grow assets and lend; we want to make sure that it is justified and people are able to ultimately repay.”

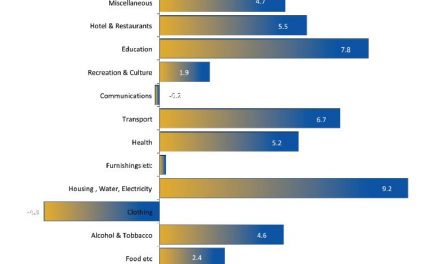

The central bank has on two occasions in the past three months threatened to look into its tool kit to reign in consumer loans, but Leyenaar said credit growth is not likely to take off. He predicts credit growth to be in the region of 10% to 14% in the near future.

Leyenaar said “ The governor [of the Bank of Namibia] again said he was looking out for any undue growth in that area (credit growth extension). At this stage we don’t see any major threat in that but he may well use interest rates if he sees particularly consumer credit extension growing well beyond the current level which could mean an uptick in interest rates.”

The FNB CEO said it remains to be seen how Shiimi will use his tool kit but monetary policy remains the major tool for the central bank to use.

“We haven’t had discussions with them on what other tools he may use but we have regular meetings. I am sure he will alert us to that.”

“I guess one of the tools will be to use certain elements of the way we lend. He might decree for instance, and this is purely an example, that you may not lend 100% of home loans which means we could end up at 80% that would immediately take out a portion of the market because there are those that do need to borrow 100%.

“That could have quite a significant impact quickly but I would suggest that is extreme, particularly as I mentioned the question is about housing, there is a housing shortage, a shortage of 90,000 to 100,000 houses. There is no land available, it is too expensive and our view is that we want to see land freed up, we want to partner appropriate developers to do infrastructure funding, particularly at the lower end.”