Economic activity other than mining remains bearish

BMI Research, a Fitch Group Company reported this week on Thursday that proposed regulatory changes are likely to hamper Namibia’s mining sector, particularly uranium production, an outlook that has not changed since their last assessment four months ago.

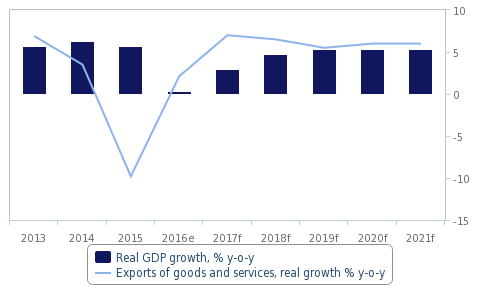

“We have downgraded our forecast for growth in 2017 to 3%, from 4.5% previously, as activity outside of the mining sector will be weak,” BMI said.

The Husab Mine, which is 90% owned by China General Nuclear Power Company, has an expected output of 6800 tonnes of uranium oxide per year but full production will only be reached late this year. According to government estimates, this production plus the increased output in gold, will see an 18% surge in mining output for the year.

Much hope is placed on the increase in uranium oxide exports as the Chinese government pushes its own agenda to increase its nuclear power generation capacity. Additionally, uranium projects like the Etango project of Australian miner, Bannerman Resources, are expected to come on stream the moment the spot price goes above US$35 per pound.

MinningWeekly.com also reports from the same economic assessment of Namibia’s uranium production that despite Namibia’s good standing, certain proposed regulatory changes, such as adverse taxation and economic empowerment in the form of the NEEEF bill could hamper growth prospects for other commodities such as copper, gold and zinc.

“While the NEEEF Bill will likely see push back from the private sector in the months ahead, uncertainty surrounding it will negatively affect foreign investor sentiment around the country’s mining sector,” BMI said.

Data quoted by BMI, based on the preliminary national accounts, suggests that real GDP growth decelerated from 5.7% in 2015 to 0.3% in 2016, below BMI’s already lukewarm estimate of 1.5%. With full production capacity at Husab expected to be reached by August 2017, BMI expects Namibia’s uranium production to grow by 70% year-on-year in 2017, “allowing the country to become one of the largest uranium producers globally by 2021, when the country’s uranium output is forecast to reach 8500 tonnes.”

Looking at the overall mining industry, BMI stated “Namibia is one of the more attractive destinations in the African region from an investment standpoint due to its solid infrastructure, openness to trade and strong legal framework. However, its vastly dispersed and relatively poorly educated labour force, high levels of red tape and underdeveloped financial markets, continue to constrain growth.