Namibia’s SACU slice at mercy of SA’s credit rating further deteriorating

Owing to its linkages with the South African economy and financial markets, Namibia is likely to lose out significantly if the downgrading of the South African leads to a decrease in the Southern African Customs Union (SACU) revenue pool.

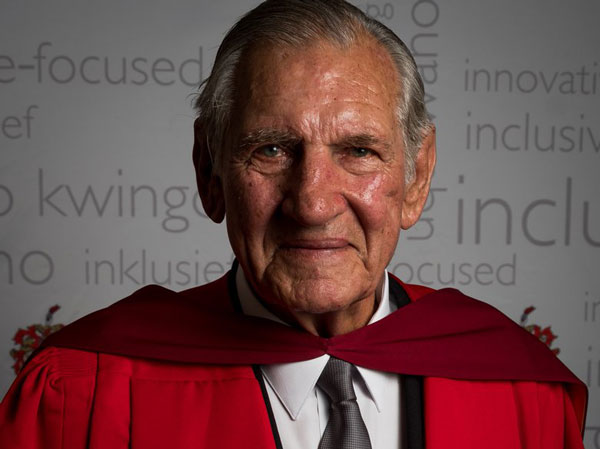

Economist for the advisory firm NKC African Economics, Gerrit van Rooyen speaking this week on Namibia’s position relative to South Africa’s lower rating and higher debt cost, told the Mail and Gaurdian SA that income from the customs union forms a disproportionately large part of the fiscal revenues of Botswana, Lesotho, Namibia and Swaziland (BLNS).

In Namibia, the expected allocation to the national budget from the SACU revenue pool will constitute 34.76% of expected fiscal income for the 2017/18 budget.

Van Rooyen pointed out that “The majority of these nations’ [SACU members] imports are from South Africa, so increasing costs in South Africa would also fuel higher inflation in those countries. The funds are dispensed through the South African National Revenue Fund.

“Namibia may not to be as resilient to a downgrade to junk status as South Africa, because its economy is comparatively less diversified and its financial markets and revenue agency are not as well developed,” Van Rooyen said.

South Africa as a result of downgrades is in jeopardy and could ultimatley lead to Namibia losing its investment-grade credit rating. “If South Africa continues to suffer further downgrades, it is inevitable that Namibia, owing to its linkages with the South African economy and financial markets, will also lose its investment-grade credit rating,” he said.

Namibia has investment-grade credit ratings from both Fitch and Moody’s but these are just one notch above subinvestment grade. These ratings, Van Rooyen said, came under pressure before South Africa’s downgrade. Both agencies had revised their outlook for Namibia from stable to negative towards the end of last year.

The customs union allows an unrestricted flow of goods and services between member states, and customs and excise revenue is shared based on the so-called Revenue Sharing Formula.

A further decline in South Africa’s credit rating will affect the country’s economic growth and inflation negatively, and indirectly those of the other members of the customs union.

But it could be argued, Van Rooyen said, that Namibia might lose the most if South Africa’s debt is downgraded further. “This means that the BLNS countries are very vulnerable to declines in the level of customs collections, which depend on regional economic growth,” he said. “The downgrades jeopardise South Africa’s expected modest growth recovery and, hence, the expected recovery in SACU revenues.”

“A lower investment rating and higher debt costs for South Africa as a result of the downgrades will weigh on its economic growth, which in turn “will weigh on bilateral trade with the BLNS countries, SACU revenues and consequently the BNLS growth rates and national budgets”, he said.