Credit growth lower for fifth straight month, rebound could be near

Credit demand growth could tick up a notch higher again in 2017 if the moderate recovery in commodity prices and Namibian dollar-strength since 2016 continues, which would boost economic growth and moderate inflation, respectively, according to the central bank.

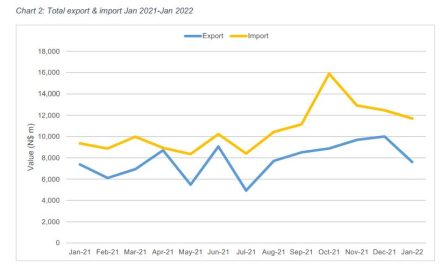

Private sector credit extension (PSCE) growth declined further in January, mainly as a result of a decline in both demand for credit from the corporate and household sectors, said, BoN.

A recently released Money and Banking Statistics report shows PSCE growth decreased for the fifth consecutive month to a 8.5% yearly in January from 8.9% year-on-year in December. Growth in total credit extended to the corporate sector decreased to 8.2% year-on-year in January from 8.5% year-on-y ear in the preceding month.

The slower growth in corporate credit was mainly reflected in ‘other loans & advances’ (i.e. personal loans and credit card advances) and overdrafts. Growth in credit extended to households dropped to 8.8% year-on-year in January from 9.4% year-on-year in December.

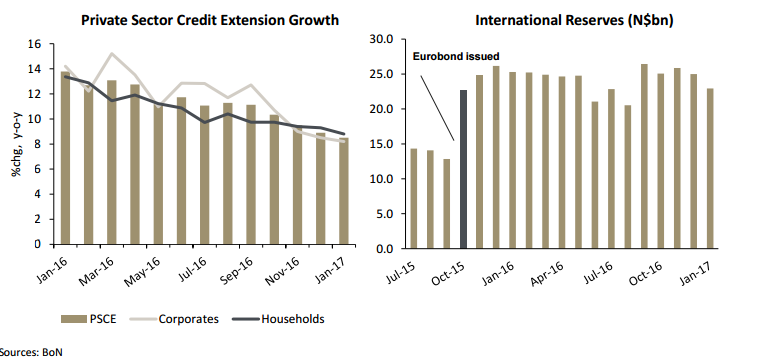

The growth in total mortgage credit, which accounts for more than 50% of total PSCE, rose to 9.2% yo-y in January, compared to 8.7% y-o-y in the preceding month. Elsewhere in the report, the central bank highlighted that the stock of international reserves declined to N$22.9bn at the end of January 2017, compared to a higher level of N$24.9bn at the end of last year.

The BoN said the 8.3% month to month drop in reserves in January was due to the effect of exchange rate appreciation. The average Namibian dollar exchange rate against the US dollar appreciated from N$13.60/$ in December 2016 to N$13.50/$ in January 2017.

In its latest Monetary Policy Statement in February, the central bank said that the stock of international reserves in January was estimated to provide 2.8 months of import cover and that this level of reserves remains sufficient to sustain the link between the Namibian dollar and the South African rand.

Annual PSCE growth has been on a broad decline since March 2015, when corporate credit demand growth peaked at 25.6% year-on-year. The decline in overall credit demand during this period reflects a slump in economic growth, a higher inflation environment, tighter monetary policy and changes to the Credit Agreement Act (which requires a deposit of 10% on all vehicle loans and limits repayment periods to 54 months).

Growth plummeted last year as mining and construction output slumped and the annual inflation rate rose steadily throughout 2016, driven by drought-affected food prices – inflation most recently reached a seven-year high of 7.3% in January 2017.