Problems? What problems? Everything is on track in cuckoo land.

Nobody seems to get it. The government is too big and the government’s participation in the economy is way too big.

It was a brave attempt by the Minister of Finance earlier this week to assure us of the soundness of the fiscus. Coming from such a high-ranking government official, it was a great comfort to be told everything is hunky dory.

But is it?

What is happening on the ground, at operational level so to speak, does not support the minister’s view, or least the view he tries to sell us. Companies are not doing well, banks are tight on liquidity, households are struggling, stagflation has taken hold of the broader economy, and thousands of people have been retrenched across the board.

Let’s reconsider for a moment, the size of the government. The government directly employs roughly 120,000 people through the ministries and some agencies. This is according to its own published figures. How many are employed by so-called parastatals is not known to anybody outside those companies. I am also not aware of a published figure for total employment by parastatals.

The government contributes directly about 44% of the economy. A multiplyer of 1.65 pushes this figure up to just above 70%. This may be exaggerated and a more conservative estimate will probably state 65%. This means almost half of the economy is directly driven by government spending, and about two thirds by the liquidity that originates from primary expenditure.

This is out of all proportions to the productive capacity of the local economy. And it does not matter how many development plans we put on the table, if the overall emphasis does not move from consumption to investment, we will just run into another financial crisis further down the road.

The government’s economic contribution must be maximum 20%, and that is on the high side. In the same vein, the civil service must follow the same proportions, not employing more than 60,000 people.

From these very broad comparisons, it shows the government is about 100% too big, or double the size it is supposed to be.

So it was good to hear we are doing so well. The expenditure savings have been made and the frontloading of this year will help reduce the impact in the next budget, but if the bloated civil service remains the size it is, the problem will not go away, it will only pop up again at a later stage.

It is obvious that the country at large is not suffering from a balance sheet problem but from a cashflow one. But it is equally obvious that cashflow can not indefinitely be sustained by borrowing money. At some point, productivity and profitability must come into the equation.

The official point of view is that we are not nearly in the same position as many of our peers and that there is much room to continue financing operational expenditures from borrowed money. The only problem is, the market does not agree.

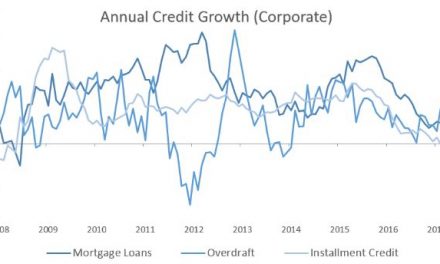

Liquidity is constrained because the private sector’s profitability is severely compromised. And at least half of the reasons for the dip in profits, is the fact that most companies do a very substantial part of their business with government ministries and agencies.

It is easy to use the decrease in government revenue as an excuse why the expenditure side of the budget is under strain, but this does not remove the fact that the government itself generates about half of the business on which it collects taxes.

Ultimately, I believe we need an honest assessment now if we want to avoid a debt trap. Our problems did not start with depressed commodity prices or the drought, or the retail collapse in Angola, or political fallout in South Africa, it started with successive deficits. For the period 2010 to 2015, financing the deficits were easy and nominal growth in fiscal revenue ran between 18% and 20% every year for six years. The real problems only started when we ran out of so-called fiscal space and the market started doubting our ability to continue on this road. So, in the end it became a combination of sustainability and crediblity.

It is useless to say the economy will grow 4.5% in 2017 because we believe mining will grow 18%. Those huge expectations for mining should have materialised in 2016 but it did not. We can juggle the figures, argue from a biased political perspective and do all sorts of funny stuff with the figures, we will still not get around the fundamental issues. The government is too big, the civil service is double the size what is needed, the private sector is being crowded out, and we are growing an economy on debt, not on productivity. It is not sustainable!