Two negative outlooks, one overhauled budget

What is going to happen to the economy after the new budget?

When Moody’s revised Namibia’s sovereign outlook in December from stable to negative, it created a flurry of opinions in the local financial services industry. But it will be good to remember the words of the finance minister on 29 October last year when he reminded his co-parliamentarians that the rating has not been downgraded, only the outlook revised. This he had to do after Fitch revised their outlook in September, also from stable to negative.

Now it must be fairly obvious that both ratings agencies will not change the outlook if circumstances did not change. And while the ratings methodology is very technical, and in a sense academic, it is based to a large extent on the outcome of the so-called Article IV consultations between the International Monetary Fund and the Namibian Ministry of Finance during November.

So it is quite telling, that Moody’s revised the outlook shortly after the release of the IMF Country Report, but still went to the trouble of confirming the existing rating only two weeks later on 18 December.

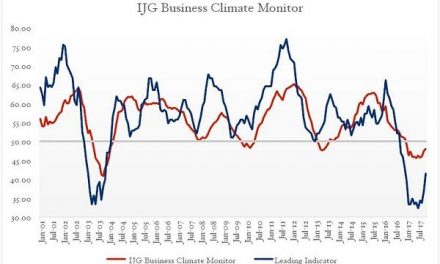

For the ordinary, non-technical person who still depends on the direction of the economy, this must be rather perplexing. In many discussions, the reality confronts us that 2016 was a terrible year. This is immediately obvious from the available facts but there is also a large body of anecdotal evidence suggesting that liquidity for the country as a whole took a nose dive.

When the 2016 budget was tabled early last year, the GDP nominal growth rate was pencilled in at just over 14%. Early estimates put the real growth rate at 4.4%. This bubble was burst, first by the Bank of Namibia, and later by the finance ministry when they stated we would be lucky to achieve a 1.6% real growth rate. Unfortunately, in the absence of timely statistics, that will remain an intelligent guess until about July this year.

Nevertheless, it is clear that official estimates radically downgraded growth, a move supported by the quarterly performances as captured, processed and published by the Bank of Namibia in its quarterly bulletins. From the latest one published in December covering the third quarter of last year, it became apparent that the economy was in recession, at least for that 3-month period.

At the tabling of the Midyear Review of the budget on 27 October, the minister used the same 1.6% GDP growth estimate showing me that the source of this information is the same as that of the central bank. Yet, in that same speech, the minister tentatively put in a projected real growth rate for 2017 of 5.1%. Again, one can not help to notice that this is substantially higher than the 4.4% initially expected for 2016 so it makes me wonder, where will the financing come from for such positive growth.

While the finance ministry is holding its cards very close to the chest, I do not believe the minister would have stuck his neck out like that, a mere two months ago, were it not with the knowledge that there is some strategy or Plan B in place, or being worked on.

In the 2016 budget, GDP for 2017 was projected at just over N$219 billion. For this year it was supposed to be N$189 billion. Using the same deflators as the minister I come to the conclusion that 2016 GDP will probably come in a notch below N$180 billion. If I assume a growth in private sector credit of around 12%, and an average annual inflation rate of 6.6%, then real growth for 2017 should be just above 5%.

I have this sneaky suspicion that come the end of February, the finance minister will pull a rabbit out of hat, and present us with a budget based on an assumed GDP of N$200 billion. This puts us back some N$20 billion from last year’s projections but I feel it is not unrealistic.

It is difficult to quantify the multiplier effect of the billions of additional government stimulus that went into the so-called preferential sectors from 2010 to 2016 but it is completely unrealistic to argue that so many billions of dollars have not worked to create a much larger generating capacity in the economy.

In a sense it is jumping the gun, but I still believe that the government’s current troubles are not balance sheet problems, but cashflow constraints.

Of course, the unknown in all of this is the capital market. We can not predict what the sentiment from investors will be, but if the cuts in the midyear review produce the intended results, the sovereign ratings will not be affected although it is possible that the outlook will remain negative, perhaps for another semester or a full year.

If the ratings are maintained, I believe this will constitute a positive signal and we should see activity in the capital market picking up.

The core question now is what sort of budget deficit is the ministry playing around with? That will be the key issue.