Bidvest profit tumbles, again

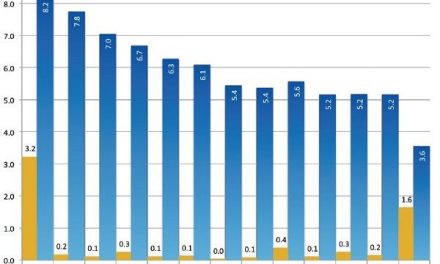

Bidvest Namibia this week released its results on the back of a declining horse mackeral resource and allocation. According to Bidvest, while its revenue rose 9.2% its trading profit for the year came in at just about N$294 million, marking a 28% reduction.

Said Bidvest of its results, “Bidvest Namibia delivered disappointing results given the difficulties that were faced in the Fishing and Freight & Logistics divisions and Voltex. Fishing’s trading profit decreased by 41,8%.Our Angolan business struggled with vessel breakdowns, United Fishing Enterprises made losses due to pressure on pilchard resource and the horse mackerel business decreased in size, as well as a 21% drop in hard currency prices. The average exchange rate had a 26,1% positive impact on revenue, but had same impact in some United States Dollar denominated costs.”

On the plus side, three acquisitions which were made during the current financial year, using cash resources added diversity and greater opportunities for the market Bidvest said. Said PSG Namibia in their analysis of the just released results they said, “The group’s headline earnings for the 12 months ended 30 June 2016 came in 16.5% lower than the comparative period last year, attributed to insufficient horse mackerel quotas and suppressed selling prices, reduced pilchard resources, zero project activity for Manica and Voltex continuing to struggle. Encouraging signs are the turnaround of the Food and Distribution division and Novel Ford Motor Company boosting revenues.”

PSG added, “The results were largely expected. The share price was flat over the past year but remains marginally above our target price of 965cents per share. The Price Earnings ratio at 12.2 is still demanding given the uncertain growth prospects. Our target price and recommendation will be updated i our full results review report.”

IJG also had something to say over the results. Commenting, they said, “Bidvest Namibia delivered poor results for the 2016 financial year. As we expected, the firm’s results reflect the difficulties the fishing division finds itself in. EPS decreased 36.2% to 86.9 cents per share, while HEPS fell 16.5% to 86.2 cents per share.

At N$3.859 billion, revenue is up 9.2% from last year, mainly due to the acquisition of Novel Motor Company during the financial year, which added N$755.2 million to revenue. However, BVN’s trading profit shrunk 43.0% to N$235.1 million, primarily as a result of significantly lower horse mackerel quota available to Namsov. A final cash dividend of 18cents per share was declared, taking the total dividend for the year to 38cents per share, thus the company cut dividends by 36.2% when compared to FY15.