Shall the throne of iniquity which devices evil by law, have fellowship with You – Psalm 94 verse 20

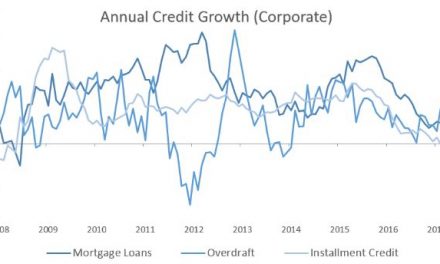

Regulation 29 compels institutional investors to repatriate 3.5% of total assets and invest these in unlisted companies through so-called Special Purpose Vehicles, a legal framework for investment which is supposed to make all investments transparent and subject to constant monitoring. The only problem, as expressed so elegantly by the MD of Stimulus Investments, is “you know as well as I that there are no liquid assets in the Namibian market.”

This statement from a company that specialises in Private Equity sums up the huge conundrum local investors face when they chase the few local investment opportunities. And the shortage is so massive, compared to the amount of capital that must find a new home, that it distorts local asset prices, upsets local liquidity and leads to all sorts of investment gymnastics.

It is clear that the policy makers in the Ministry of Finance must have put their minds to this problem. If there is ample capital chasing a limited supply of goods, it does not take a degree in flow dynamics (rocket science) to figure out, first, that Regulation 29 has the potential for significant financial disruption, and second, that the capital will probably always exceed the value of the available assets, the goods.

Enter someone with a clever solution, but with much unintended consequences. Let us simply force all business owners to sell 25% of their shareholding. The government has the political mandate to force through any legislation they want regardless how ill conceived. Furthermore, the government is such an overbearing player in the economy, the 44% they contribute to the economic cake has slowly eroded and reduced the role of the private sector. In a very simplified way, it can be said that the government is now almost half of the economy while private business is crowded out more and more every year.

So basically, the government can do what it wants, and cloak everything in a pretence of legality by using the Parliament to approve any law whatsoever. However, consideration for immediate disruption is often absent while the long-term unintended consequences are far beyond the radar of short-term expedience.

Then the solution becomes simple. If there is so much capital looking for a home but the assets are rather restricted in both volume and value, then let us simply create another law, forcing the capital to find the goods. And if we wait long enough, future economic growth and expansion will eventually enable us to catch up with inflated asset valuations that will be a direct consequence of restricting the already impeded free-market mechanisms.

The New Equitable Economic Empowerment Framework is a noble work based on good intentions and clear expectations. The execution and implementation of these expectations are a different kettle of fish. The bill based on the framework, in its current format, is a disaster.

In the first sign of rational minds returning to the debate, the Ministry of Finance this week extended the deadline for response and submission from the end of March to the end of April this year. This, at least, is a good sign, indicating that there must be some individuals with savvy among the army of advisers, both local and foreign, serving the ministry.

I think what few people has considered so far, is that the mechanism proposed by the NEEEF Bill is exactly the same as that of Private Equity as an asset class, except that it functions irrespective and independent of any willing seller, willing buyer principle. The ministry knows that if it does not force all enterprises to sell part of its shareholding, the problem it has created through Regulation 29, will not go away in the next decade.

One specific problem is that the availability of Private Equity is very restricted as can be attested by all companies that specialise in this asset class. Another obstacle is that valuations for Private Equity are often subjective and divorced from free market principles. But it still boils down to the fact that Private Equity investors will be favoured massively by the NEEEF Bill as the skills required to invest in and manage private companies, simply does not exists in a sufficiently large segment of the population.

In a round-about way, this is a form of corruption.