Go slow on that delink talk

“Ever since the Rand’s nose-dive there have been questions and queries as to why our Namibia Dollar should remain linked to the Rand, especially as it seems to pull us down as well” said Namene Kalili, Senior Manager Research and Development at the FNB Group. “De-linking a currency, however, is much easier said than done and entails numerous considerations” he cautioned at the same time.

Kalili explained that the Rand, to which the Namibia dollar is pegged has depreciated following dramatic policy mistakes in South Africa. But he advised that before anyone becomes overly concerned, “we should also remember that the US dollar has appreciated against most currencies across the globe and the rand is not its only victim.” “Essentially the depreciation will pass through in the form of higher prices for certain consumer goods such as electronics and vehicles.”

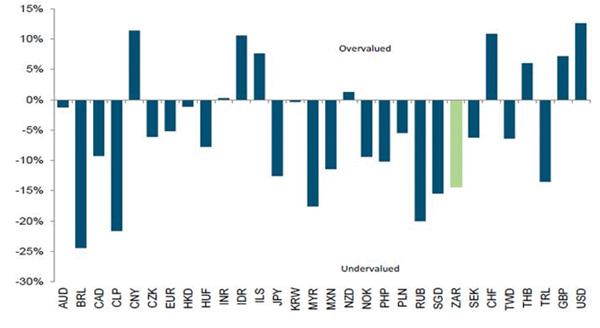

FNB Namibia has therefore increased their inflation expectations to 5.8% in 2016 rising to 6.1% in 2017. Said Kalili: “We expect faster interest rate hikes this year to contain inflation below 6% and reduce aggregate demand. It is possible for Namibia to delink from the Rand, but I do not believe it will be in our best interest. Reason being, persistent dollar strength is likely to depreciate the value of the free float Namibian dollar. Current fundamentals suggest that the Rand is undervalued and is therefore likely to recover from 2017 onwards (see graph below).”

He added that currencies are determined by a host of fundamentals and market sentiments. Given Namibia’s limited FX reserves, a free float Namibia dollar is likely to be more volatile than the Rand. Event risks such as drought, the energy fiasco or struggle kids unrest, would in all likelihood weigh down on the free float currency, leading to more depreciation.

Kalili said that launching a new currency is a long term project during which countries need to show the global community that they are able to manage interest rates, inflation rates, balance of payments, government expenditure and economic growth, amongst other things. “Then the country must have adequate reserves to back the currency in circulation. Where our money gets printed and determinants of money supply become important considerations. We also need to consider our trade partners. Trade between Namibia and South Africa, our biggest trading partner, would become more complex as foreign currency translation now enters into the equation. Therefore, this is not a decision to be taken lightly and has to be taken with a long term view.”

He still feels Namibia is better off under a linked currency regime. “We do not have the market size to influence the price for our currency, neither do we have the human capital to manage a free float currency.” He encouragingly stated: “The Rand will recover, it’s only a matter of when, as the fundamentals point to an undervalued Rand. So as traders take advantage of the price advantage, the Rand will appreciate and normalize. Furthermore, markets have now factored in the Zuma effect into Rand pricing and as soon as his term runs out, the currency should normalize.”