Even worst performing typical pension fund investment managers outperform the JSE Allshare index: Should your asset manager factor political considerations into investment decision?

Tilman Friedrich is a qualified chartered accountant and a Namibian Certified Financial Planner ® practitioner, specialising in the pensions field. Tilman is co-founder, shareholder and managing director of RFS, retired chairperson, now trustee, of the Benchmark Retirement Fund.

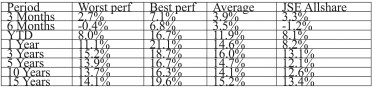

When you listen to money managers of pension fund investments, they say their investment horizon is the long-term and they will caution not to be overly concerned about the short-term. They will also tell you that in the long-term you should be invested in equity as equity has historically proven to outperform all other ‘conventional’ pension fund asset classes. But look at this table:

The interesting conclusion is that even the worst performing typical pension fund investment manager managed to outperform the JSE Allshare index over all periods barring the year-to-date, where it was on par with the JSE Allshare Index. Does this prove the adage wrong that equities outperform all other conventional asset classes over the long-term?

No, it does not but what this does show is that by adapting the mix of asset classes in the pension fund investment portfolio in the light of market conditions, investment managers manage to outperform equities. How is this possible you may ask? Well the point is that there are the short- and the medium-terms when other asset classes outperform equities and if the investment manager does his job well, as it seems they generally do, he pre-empts swings in fortunes between the different asset classes by switching between these in good time. The best quality investment managers need to possess in this regard is discipline. Set your pointers when to switch out of an asset class and when to switch into an asset class and do this consistently and in a disciplined manner.

But what about the political environment? Can you divorce the political environment from the economic environment? We believe you cannot. Political structures employ all means at their disposal to achieve their economic objectives and wealth is the ultimate goal of our economic system. We evidence on a daily basis that the world is not a unipolar system but that there are competing forces that go to any extent to achieve their economic objectives. So what happens if we invest in a country that all of a sudden falls out of favour? Take Lybia, Syria, Iraq or Afghanistan. Not too long ago many investors would have considered these countries for investing – and most of those that have invested would have lost all of it or pretty close to all of it and it is not a question of such an investment ever recovering again because it simply no longer exist. This would be a permanent loss and such losses must be avoided by an investor at all cost. Today we may think China is a sound investment destination, or Russia, or Turkey or even Europe but are they still going to be a sound destination next year or in 10, 15 or 20 years when you get to retirement and would like to start drawing on your retirement capital?

So what happened to Libya, Syria, Iraq and Afghanistan? Is it fair to say they crossed swords with the wrong sparring partner? What is the chance of this happening to Turkey, Russia or China? There are clear signs that China and Russia are not well aligned with our biggest global sparring partner and it is quite conceivable that this sparring partner is busy or has already taken aim at these emerging competitors also referred to as threat. Most investment managers are still happily investing in China as some have invested in Russia and have taken serious losses on behalf of their pension fund investors. Of cause at this stage these losses are still of a temporary nature and one can hope that they will recover once the environment normalises. Problem is – if it gets worse the temporary losses can very well turn into permanent losses.

If I were the biggest global sparring partner I would consider China as my biggest threat for preventing me from laying down the rules for the global economic game. To neutralize this threat China would have to be encircled first of all and with Russia preventing an entry through the back door, this hurdle would have to be eliminated. To preserve my resources though, I would get others to do the job for me as far as possible.

These others could conceivably be Europe, Turkey and a few more. Is this what we currently see unfolding in Europe and the Middle East?

As an investor I would certainly be concerned about any investment in Russia, Turkey and the Middle East and I would not be overly comfortable about an investment in Europe either because if Russia is being pushed into a corner it has no alternative but to resort to its ultimate arrow in its quiver and that could mean serious trouble. China of course will know that Russia is it Achilles heel and is unlikely to remain a spectator in this game.

One may say this is an apocalyptic scenario. Shall we therefore hope that Russia will rather start towing the line soon, which should give us a few more years on China unless China also starts towing the line? In this scenario it would seem that South America and Africa should be able to stay out of the cross fire and these continents should present fairly safe investment destinations. Taking a bet on who the winning side will be at least for the next 50 years or so, the investor could be a bit bolder and consider investing in North America.