October / November 2015 Part 2

In last week’s column I talked about valuation of bourses. Now let’s turn to oil, the commodity with the biggest impact on global financial market. At its current price of US$ 50 per barrel, the global oil market is equivalent to around 2.5% of the global GDP. At its peak of US$ 140, it was equivalent to close to 7% of global GDP. GDP being a function of money supply and the velocity of money flows, the steep increase of the oil price certainly heated up the global economy while its more recent decline will obviously have the opposite impact.

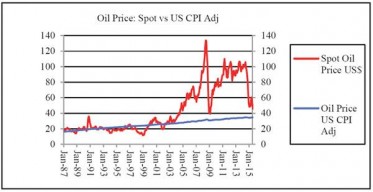

The following graph reflects the spot oil price as against the oil price of 1987 adjusted for US CPI.

One may conclude from this graph that there was a close correlation between the CPI adjusted price of oil at its 1987 level and the market price until around 2003 when became airborne for reasons we have been speculating on in previous newsletters, until it started its steep decline in the middle of 2013. If one gives the CPI adjusted price the benefit of the doubt of it not fully reflecting all cost drivers in the oil industry, one can conclude that at current levels, it has reached a fair level relative to its 1987 level.

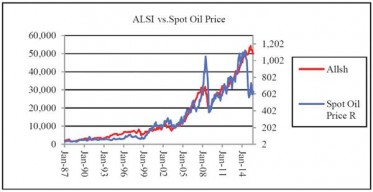

Oil is a key driver of the global economy and should thus also be a key driver of global bourses. The following graph considers this assertion.

Clearly, the SA Allshare index has been very, very closely correlated to the oil price, adjusted for the depreciation of the Rand over this 29 year period, until the bottom fell out of the oil price in the middle of 2013. What can we deduce from this picture? If the Allshare index will revert to being closely correlated and if the oil price currently reflects a normal price level, the Allshare should decline to 30,000 from its current level of 50,000. This sounds quite far-fetched although it will be difficult to fault the principles. Let’s assume then that the Allshare will rather takes a breather until the oil price in Rand has caught up again as the result of a gradual depreciation of the Rand and the increase in the cost of producing oil at a rate of 5.5% per annum, taking the past year as our point of reference. What will this mean? It will mean that it will take about 12 years until the two trend lines are in synch once again! The oil price in Rand will then be around R 1,100 per barrel as opposed to its current price of around N$ 650.

Finally let’s look at another key economic indicator, the Rand/ US$ exchange rate and try to make some assertions on this. The below graph depicts that Allshare index and the Rand/ US$ exchange rate.

Interestingly these two lines are also very closely correlated for most of the time. Having concluded from the previous graphs that the Allshare index could decline to 30,000 this graph tells us that if this were to happen the Rand could strengthen to 8. Let’s once again say this is far-fetched and believe correction will only happen through the correction of the oil price in Rand taking the past 12 months as frame of reference for its future trend. In 12 years’ time when the Rand price of oil has caught up with and Allshare index of 50,000, the Rand is expected to have depreciated to around 22 to the US$.

The question is whether we will face a 12 years’ catch-up game or whether there is anything else that can accelerate the flow of money and get the global economy going again? Interest rates are extremely low, so is inflation while consumption is simply not responding to the massive money supply into the financial markets since the financial crisis. Things being as they are, the accelerator function of oil does not offer an effective mechanism. It’s hard to think of any other commodity of global dimensions that will achieve this result without any massive upheaval – or is this what we are witnessing with the massive refugee crisis in Europe, the human labour commodity?