October / November 2015 Part 1

With information technology having managed to create a network of instant information flow across the globe, it is commonly accepted that we all suffer from information overload. We are losing perspective and in consequence are exposed to making conclusions and decisions based on a distorted view of developments in global financial markets. Take the following graph –

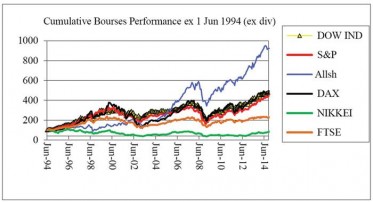

It depicts the movement of a number of large global stock exchanges. It’s a very busy graph despite only covering 6 stock exchanges. But at first sight it may lead one to identify three trends. Firstly on the downside, the Nikkei that has not moved anywhere over this period of over 20 years and secondly, on the upside, the JSE Allshare Index that was in a flying mode. But look at the next graph for perhaps a bit more perspective –

Here we have only the Allshare measured against the US S&P 500 that is in the middle of the crowd in the top graph. This graph now removes the impact of inflation that can distort the picture significantly as one can see from comparing these two graphs. Now the Allshare has actually de-linked from the S&P 500, having been quite closely aligned from 2007 until 2012, but both trend lines are still very similar. So, we can now conclude that the Allshare has actually not become airborne as the top graph seems to indicate but has been moving very much in line with other bourses, except that the local inflation rate has been substantially higher throughout.

Can we say that both markets are expensive? Well what should be driving stock prices, if anything? Talk to any business person and he will tell you that their business should grow at least in line with the economy. The S&P 500 index insinuates that the economy has grown by 4.5% per annum over this 20 year period while the Allshare index suggests that the economy has grown by only 3.9% per annum. It is probably true that these figures are not directly comparable as SA listed companies are probably serving a different economy than US listed companies, latter being much more globally focused. We would argue that these two bourses may be expensive but they are certainly not ridiculously expensive based on what this graph allows one to conclude.