Wesbank’s vehicle finance applications declining

South Africa’s new vehicle sales continued to decline in May, according to the latest data from the National Association of Automobile Manufacturers of South Africa (Naamsa). A total of 47 868 new vehicles were sold last month, representing a 3.2% decline, year-on-year.

Passenger car sales declined 5.4%, year-on-year, with sales totalling 31 201 cars. Light Commercial Vehicle (LCV) sales, however, saw a 2.2% increase in sales compared to the same period last year, shifting 14 182 vehicles.

Sales for other commercial vehicles (comprising medium, heavy, extra heavy, and bus) declined 4.5%. Year-to-date, the total market is down 1.3%.

“Over the last few months we’ve seen a rise in the overall cost of mobility. Fuel prices have increased 18% since the start of the year as a result of a weaker rand, and the Reserve Bank has warned of interest rate hikes in the coming months,” said Rudolf Mahoney, Head of Research at WesBank.

“Factors such as these will continue to affect consumer confidence and put household budgets under even more pressure. For many consumers buying a new car may not be a priority in the immediate future,” he added.

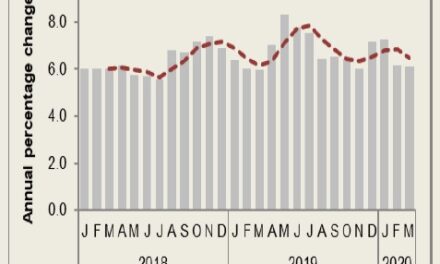

New vehicle price inflation (VPI) is currently at 7.6% (TransUnion Auto) and continues to outpace consumer price inflation (CPI), which is currently at 4.5%.

This is mainly as a result of the continued weakening of the rand, as well as low consumer and business confidence levels, as indicated by the FNB Bureau of Economic Research (BER) and RMB BER confidence indices.

These factors have resulted in new vehicle finance applications declining 7.1%, year-on-year, while used vehicle finance applications only receded 2.2% for the same period. The smaller decline in used vehicle finance applications is indicative of the activity in the pre-owned market. This is reflected in the used-to-new sales ratio, at 1.43:1 – the same level as seen in January 2012.

“The decline in May’s new vehicle sales remains in line with our forecast. We expect sales to bounce back in June, as manufacturer incentives drive end-of-quarter sales,” said Mahoney.