Accident fund engages in wellness intervention

Leading by example: MVA Fund Acting Chief Executive Officer, Fanuel Uugwanga in the testing van during the intervention.

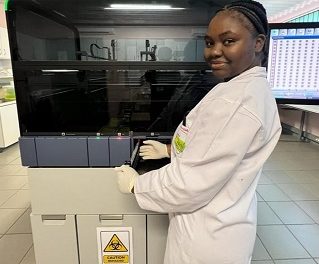

Last week, the MVA demonstrated its commitment to the wellness of its workforce by engaging its employees in an Employee Wellness and Prevalence intervention, through which employees were tested for, amongst others, HIV, Hypertension, Cholesterol, Diabetes and Hepatitis B. The Body Mass Index (BMI) of employees was also checked, followed by health education as well as Therapeutic massages as stress and pressure relievers.

The wellness intervention was conducted at the MVA Fund Service Centres in Windhoek and Ongwediva. As part of the programme, the Fund encouraged employees to enhance their physical fitness, maintain healthy relationships and eliminate risky behaviours such as smoking, unprotected sexual activities and excessive alcohol intake. The MVA Fund Acting Chief Executive Officer, Fanuel Uugwanga encouraged the employees to participate in the wellness activities, particularly to get tested for various lifestyle conditions and invest in their health.

According to Uugwanga, the wellness intervention will not only enable the Fund to gauge the health levels of its workforce, but will boost the employees’ health and subsequently promote a healthy workforce that delivers great service to the public.