EBH Namibia on current oil price storm

EBH Namibia is a local ship repair company strategically located to serve the west coast of Africa.The company operates three privately-owned floating docks in Walvis Bay, including a panama-sized dock. It is a joint-venture operation between EBH South Africa and the Namibian Ports Authority.

According to EBH Namibia, the company services a number of offshore support vessels operating off the west coast of Africa and approximately 80% of EBH Namibia’s core market operates in Angola.

Said Hannes Uys, CEO of EBH Namibia,“the impact that the burgeoning West African offshore oil and gas industry has had on Namibia, and specifically Walvis Bay, has been significant.”

“Between Africa’s top two oil producing countries Nigeria and Angola, placed 13th and 15th as global oil producers respectively, there are currently in the region of 322 offshore support vessels and 68 oil rigs. On average for each oil rig operating, up to 6 support vessels are required,” noted Uys.

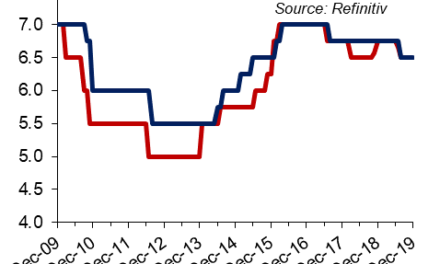

“As a result of the oil price drop, from over US$100 (on average for the past four years) in the middle of last year, to below US$60 currently, we have seen a reduction in the utilisation rates of rigs and offshore supply vessels (OSV) of 11% and 8% respectively,” Uys said.

“It is important at this point to ask the question, just how badly will the sustained low oil price affect the Namibian economy and the ship repair industry? Some might argue that the drop in the oil price, for a country that does not produce or export oil, is a good thing and certainly both private individuals and large energy-producing industries can only benefit from a lower fuel bill as a result of the low oil barrel price,” added Uys.

“However, for Namibia and its ship repair industry, there are very real risks in the wake of the current economic crisis which oil producing countries find themselves in, as a result of the sustained low price of crude oil. The questions remain, how serious are these risks, and how do we, as a country and an industry, safeguard ourselves against them?”

“No-one linked in any way to the oil industry is immune to the impacts, if you ‘close the tap’ at the top , not only ship repairers, but every single player downstream in the channel will feel the effects.”

According to Uys, EBH Namibia’s estimated downstream impact on the economy, since inception in 2006 to date is in the region of N$5 billion. With 845 employees, it is estimated, too, the downstream effect to be at a multiple of 8, resulting in a total of direct and indirect employment of 6,760 Namibians. In addition, the company procures annually an estimated N$400 million in service and materials.

“In order to ensure that it is armed with the very high-performance skills set required to deliver a world-class service in ship repair along the west coast, EBH Namibia has invested an estimated N$6 million annually in the training and development of its people,” he said.

“It is for these reasons, and the fact that EBH Namibia has an average of 130 docking-related projects over a calendar year, that as a company, we have to ensure that we carefully apply our minds, so that extraordinary thoughts lead to extraordinary actions, which in turn lead to extraordinary results,” he said.

Uys urged those in the ship repair industry, whether they are feeling the effects of a low oil price or not, not to be complacent, and to join forces against a common threat.

“We need to entrench, on a wider scale, a culture of high-performance and discipline, and in order to do this, we have to become more efficient, even aggressively so,” he maintained.

Uys called for a unified stance, urging all Namibians, in all sectors of industry, to immediately adopt a proactive stance and embrace a culture of high performance.