Debunking Sanlam’s All Namibia Fund

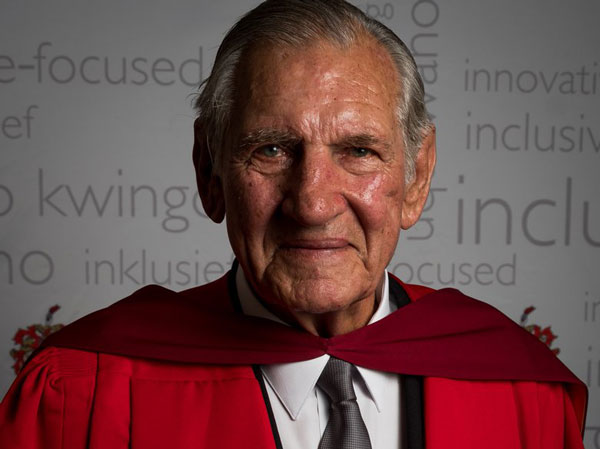

Sanlam Namibia’s Business Development Manager: Unit Trusts, Wikus Fourie.

Seeking clarity on the launch of its newest fund, the Economist spoke to Sanlam Namibia’s Business Development Manager for Unit Trusts, Wikus Fourie.

Remarking on whether there is an abundance of Namibian assets, Fourie said “We do not foresee any problems. We will mitigate liquidity carefully” stating “It is a multi-asset fund in other words our composition will be made up of money market funds, equities, bonds as well as property. We invest in primary as well as dual-listed companies on the Namibia Stock Exchange.”

According to Fourie the recently launched fund is a first for Namibia as investors are now offered the opportunity to invest their money entirely in Namibian assets. Investors, who utilise the fund are also in compliance with the local asset rule on contractual investments, which is derived from Regulation 28 of the Pension Fund Act and which states that a minimum of 35% of assets must be invested in Namibia.

Fourie added that the fund should be seen as an extension of the activities of the Government Institutions Pension Fund of Namibia. He added, “We are also not in competition with the Government Institutions Pension Fund or its appointed investment managers for these assets. We are an extension, an avenue for the man on the street who would like Namibian assets.”

Sanlam has not been mandated by the Government Institutions Pension Fund to invest assets on its behalf as far as the All Namibia Unit Trust Fund is concerned, Fourie further explained.

Sanlam’s venture can not be compared to that of Stimulus’ but it puts into perspective the expected challenge of finding quality investment prospects, more specifically given the fact that it invests in listed entities.

The country’s first pure private equity fund Stimulus Investments found itself in a tizz when it presented its year-end results in June 2014.

Remarking on its results at the time, Stimulus Managing Director Monica Kalondo acknowledged that around 35% of the company’s investment portfolio which approximated N$165 million remained under-invested and in search of quality investment prospects.

Stimulus boasts an impressive portfolio which includes a 36% stake in Plastic Packaging, 26% shareholding in Nashua Namibia, and a 50% stake in Namibia Media Holdings.